Making the rounds on a cocktail-party, you might get into a conversation regarding financial business. Sighs and you will groans are plentiful.

Numerous banks hit a brick wall with this drama, charging the us government and you will taxpayers huge amounts of bucks. Add which extensive collapse on the common allegations and prosecutions out-of S&L officials to have crime, therefore got a bit brand new team.

But the history of coupons and loans isn’t just good tale regarding failure, incapacity and you will crime. This type of specialized financial institutions go long ago to the Old-world. As well as the mid-eighties crisis failed to scrub S&Ls off-the-face of your Planet. The fresh new thrift community, though Houston installment loan no credit checks no bank account significantly reformed, switched and you may quicker within the later 1980s and you can very early 1990s, lives into the today.

First, let us investigate root of your discounts and mortgage relationships. Your age in the from the spendthrift era from Wall Road. But the truth is in fact closer to Pride and Prejudice. Keep reading.

Bill and you may Hillary Clinton testified for the an investigation with the alleged unlawful interest between the folded Whitewater Deals and you may Financing. Prosecutors accused Expenses Clinton regarding getting money from members’ discounts levels to finance their reelection quote to have governorship from Arkansas regarding the eighties. Although the Clintons were lovers in the S&L’s small business ventures, the latest prosecution never definitively linked brand new Clintons to crimes.

Treasury Secretary William Woodin gladly appears into because the President Roosevelt cues the fresh new 1933 Crisis Financial Statement, one of several methods the us government got to save this new You.S. monetary community in the High Despair.

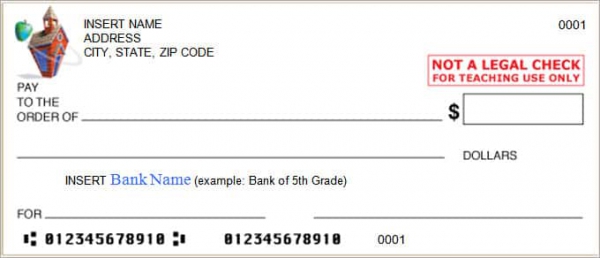

A cost savings and you will mortgage association (S&L) try a facilities one to gives currency to people who want to get a home, make renovations otherwise generate to their land. Members of an enthusiastic S&L deposit money toward discounts levels, and this cash is lent out in the type of household mortgages. Individuals pay attention on the home loans, and this focus was died towards users therefore the bank alone.

To begin with, the reason for a keen S&L was to develop organizations. S&L players generally contains local some one finding earning profits as a consequence of highest-give deals membership. Its discounts account were investment in the community. Like most other investment, S&L depositors stood to gain money. As well as helped aside its neighbors in the act.

Offers and you can loan associations, called thrift banks (such as thrifty or savings-minded), has actually a detrimental hip hop by the huge discounts and you can mortgage crises of 1980s and you will 1990’s

The design for it society-inclined monetary team goes back in order to eighteenth millennium The united kingdomt, where strengthening societies compiled money from professionals to finance the structure out of a house per representative [source: Encyclopedia Britannica]. This style of a mortgage wide spread to the us for the 1831, if Oxford Provident Strengthening Relationship of Philadelphia is actually situated. Similar creditors, upcoming called building and mortgage connections (B&Ls), jumped upwards for the communities across the country. Dealing with some regional people, B&Ls produced money entirely because of the financial support mortgage loans.

One of the most significant grounds the new offers and you will loan world enjoys an adverse profile ‘s the infamous Whitewater scandal

The city-inclined benevolence of making and financing connectivity, regardless if essentially good-for local invention, ultimately backfired. B&L bankers basically failed to make a house expenditures — which is, lenders — based on how successful its potential will be. As opposed to payouts so you’re able to weather brand new violent storm, strengthening and you will money was indeed susceptible to failure while in the a failing discount, for instance the High Anxiety of 1930s. Of numerous B&Ls were unsuccessful during this period.

President Franklin D. Roosevelt’s financial guidelines of your early so you’re able to middle-1930s written federal agencies to control financial strategies on Joined Claims. Such businesses incorporated new Federal Deposit Insurance Firm, hence covered depositor account during the commercial banking companies (the new everyman’s bank) plus the Government Offers and you will Loan Insurance rates Business, and that covered membership during the strengthening and you may financing connectivity, now called offers and you may financing connections.